My parents did a great job raising five children. The mission was always to send five kids to college and that mission was accomplished. All five of us went to college and graduated with a degree. As I look back, that journey was different for each of us. While some of us received scholarships, some of us – (like me) graduated buried in debt. Every time I receive a notification about my student loans, I wish my parents knew about Ohio’s 529 Plan.

What’s a 529 plan? The 529 plan was created to encourage American families to save for higher education, they provide a tax-advantaged way to save. BINGO who doesn’t need one?

My husband and I decided early in our marriage, that we didn’t want our kids to be burdened by student loans or debt. After a little research, we made the choice to put our tax refunds to good use. We decided anything we got back would be invested in 529 plans for all of our children. In an attempt to minimize their future debt, or possibly cover all of their higher education costs, we decided to start investing now. The reality is, every dollar saved today is a dollar that doesn’t have to be borrowed later. And despite all the uncertainty in the world right now due to COVID-19 and the need for shifting our finances, we’ve decided to stick to this commitment.

Here are a few benefits of the 529 Plan:

- Families in any state can benefit from Ohio’s 529 College Savings Plan. You’re not required to live in Ohio and your student isn’t required to attend school in Ohio.

- Your account grows tax-free and qualified withdrawals are free from federal and state income tax.

- Use at thousands of colleges nationwide, including 2-year, 4-year, graduate, and technical schools.

- No matter what your annual income is, you can invest in Ohio’s 529 Plan.

- Most plans allow contributions for a beneficiary of any age. CollegeAdvantage 529 has no age restrictions.

I’ll be honest, the idea of investing scared us, and we didn’t know where to start. The Ohio 529 Plan has dozens of options, so it was important to select the college plan that was right for us. Luckily, College Advantage has An Overview Guide to Help Decide on their website which really helps. It was also good to know that if our investment goals change, you are able make changes twice a year.

Another helpful tool was this College Savings Planner, which allows you to look at your college savings goals, projected costs and estimate what you’d need to save monthly to meet your objective. This was probably the most helpful tool to realistically put our investment and goals into perspective.

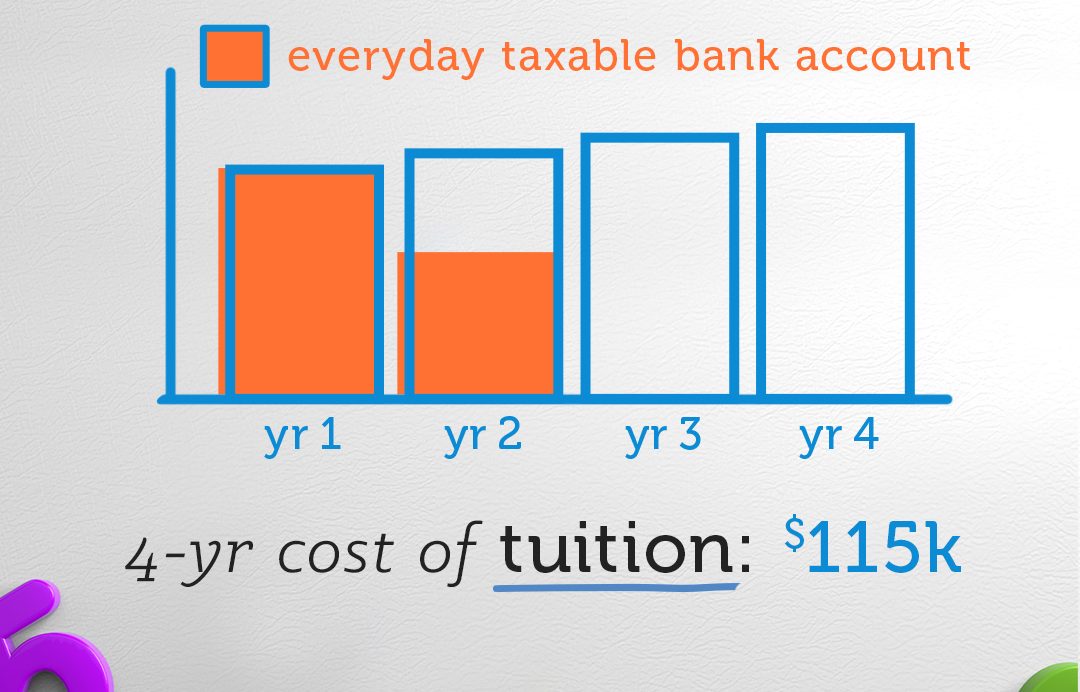

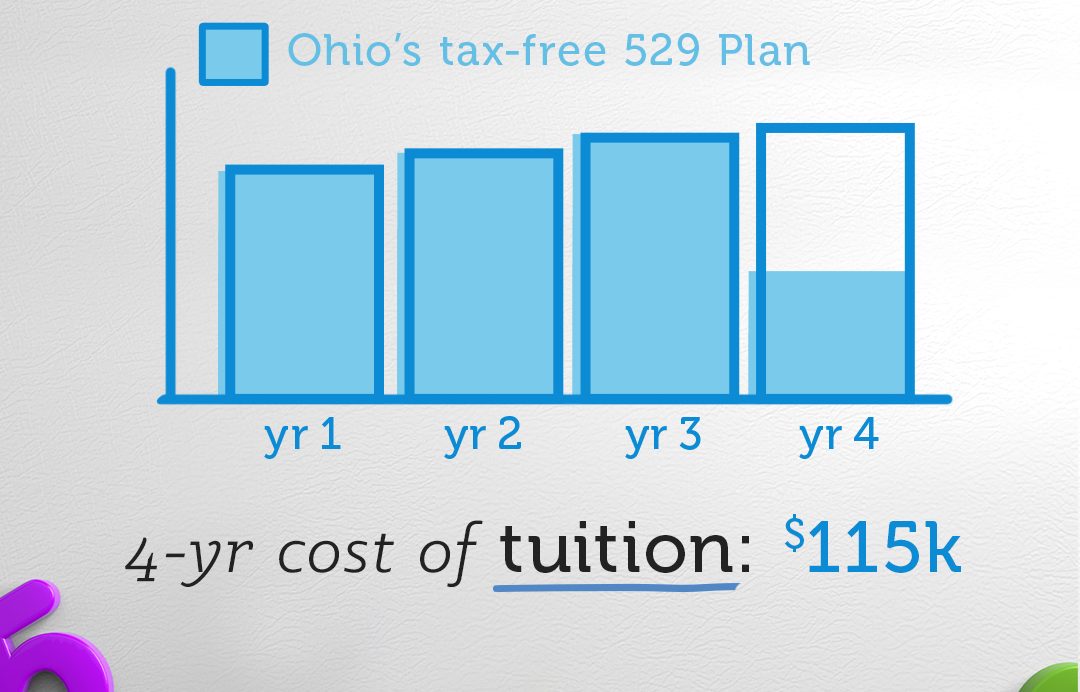

Just think, in 17 years, 4-year in-state tuition and fees might cost $115,000. If you plug the average federal tax refund for Ohioans – let’s say $2,539, which was the average for Ohioans in the 2018 tax year – into College Advantage’s College Savings Planner for 17 years, you’re projected* to be able to cover 79 percent of tuition and fees by investing that refund in Ohio’s tax-free 529 plan, versus only 38 percent of tuition and fees if deposited into an everyday taxable bank account (refer to images for chart).

Does that convince you to start investing? Whether it’s $25 or $250 it’s never too late or too early to start saving for your child’s future college costs. Did I mention people can give you contributions? Yes, that’s right, tired of toys and meaningless presents on holidays? Start requesting contributions in lieu of physical gifts. It’s genius! I know we will.

Honestly, there’s no time like the present. When you’re thinking about saving for college, think of Ohio’s 529 Plan. Whether you’re a parent opening an account or grandparents who want to contribute to their grandkids’ future, Ohio’s 529 Plan from CollegeAdvantage is the smart way to start planning for tomorrow – while seeing benefits today. Be sure you’re following me on Instagram, I’ll be giving a lucky follower $250 to invest in a plan this week! Details will be posted Tuesday 4/21/2020 at noon.

For more information or to sign up, click here: https://www.collegeadvantage.com/?utm_source=taxcampaign&utm_medium=influencer&utm_campaign=cccle

*This post is sponsored through a partnership with CollegeAdvantage however these are my real views and opinions.

No Comments